Many homeowners think that increasing their home’s value comes down to a fresh coat of paint and a newly landscaped lawn. However, there are many ways to improve your home’s property valuation that can also keep your family safer and minimize the risk of damage to your home.

What can homeowners do to increase home value? Are there insurance repercussions for home improvements? Read on for 10 ways to improve your home’s value and how they affect your home insurance rates.

Install Smart Home Systems with Insurance Perks

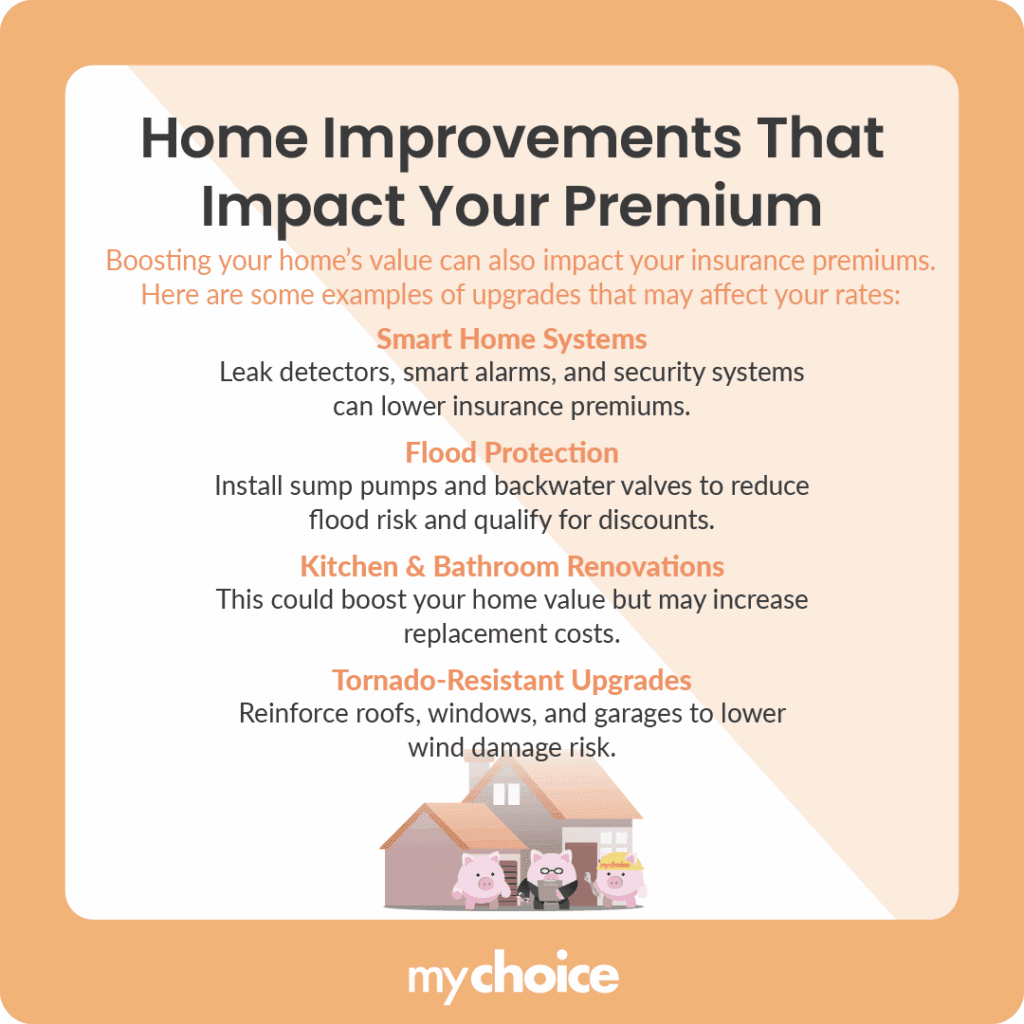

Integrating smart home technology can enhance your home’s appeal while also reducing insurance risk. These systems can include water leak detection, smart smoke alarms, and advanced security integration. These high-tech systems serve to make your home safer, which reduces the risk of having to file a home insurance claim in the future.

With a lower risk profile, many insurers may consider offering discounts to homes equipped with professionally monitored security systems or advanced safety devices, sometimes up to 13% off of your annual premium. But before installing any smart home systems, confirm with your insurer which systems qualify for discounts, ensure proper installation and monitoring contracts are in place, and verify that coverage limits are updated to reflect the new equipment’s value.

Improve Indoor Air Quality (IAQ) and Ventilation Systems

Improving indoor air quality and moisture control are essential to avoid mould and protect the well-being of your family. Installing or upgrading to heat-recovery ventilators (HRVs) or energy-recovery ventilators (ERVs) brings fresh air in and expels stale, humid air, reducing mould growth risks in bathrooms, kitchens, and basements.

While insurers rarely offer direct discounts for IAQ systems, avoiding a mould infestation (which is often excluded if tied to poor maintenance) can prevent future premium hikes or claim denials. Keep records of professional installation and maintenance logs. If your ventilation upgrade involves mechanical systems, discuss with your insurer whether any endorsements are needed.

Switch to an EV-Ready Electrical Panel

With the rising adoption of electric vehicles (EVs) in Canada, an EV-ready panel can be a major selling point. Upgrading panels and wiring to support Level 2 chargers safely appeals to buyers and ensures you can install a home charger later without another major overhaul.

From an insurance perspective, any new electrical work must comply with local codes and be performed by a licensed electrician; otherwise, a charger-related fire may not be covered. Most home insurance policies cover damage from an at-home charger if it is installed correctly. However, it’s essential to inform your insurer of the upgrade so that they can note it in your policy.

Install Solar-Ready Infrastructure

Preparing your roof and electrical setup now for future solar panels can make your home more attractive to environmentally aware buyers. Solar-ready prep includes verifying roof load capacity, adding mounting supports in re-roof projects, and running conduits from the roof to the electrical panel area.

When panels are eventually installed, insurers typically require notification and may increase your insurance coverage to reflect the solar array’s value. Premium increases vary by insurer and region. Some policies automatically include rooftop panels under dwelling coverage, while others need endorsements.

Add a Greywater or Rainwater Reuse System

Eco-friendly water reuse systems, such as greywater recycling for toilets or irrigation, and rainwater harvesting for gardening, can help with water bills and increase your home’s appeal to buyers who prioritize sustainability. However, improper installation can lead to leaks, contamination, and structural issues, potentially leading to expensive claims.

Greywater systems must comply with provincial plumbing codes and often require permits. Work with certified professionals and include leak-detection safeguards. Insurers rarely offer direct discounts for water reuse, but disclosing the system and showing professional installation ensures coverage isn’t voided later.

Flood-Proof Your Basement with Backwater Valves and Sump Pump Upgrades

Basement flooding is a top source of home insurance claims in Canada. Installing a backwater valve to prevent sewer backups and a reliable sump pump with battery backup can drastically reduce flood risk. Many municipalities offer subsidies for these installations, and insurers often provide discounts for homes with these measures in place.

If you live in a flood-prone area, consider discussing optional sewer backup or overland flood endorsements. Flood-proofing measures may be required or help you qualify for favourable rates.

Reinforce Roof and Garage for Tornado Protection

In recent years, Canada’s tornado risk has risen drastically, more than doubling in the last decade. Strengthening roof connections with hurricane straps or clips, installing impact-resistant windows or storm shutters, and reinforcing garage doors can reduce wind damage risk in case of a severe weather event.

Research from Canadian building studies indicates that modest investments in wind mitigation yield high benefit-cost ratios, potentially reducing damage repair expenses in the event of storms. Insurers often reward wind mitigation with premium credits or improved eligibility in higher-risk zones.

Rennovate Kitchen and Bathroom

Kitchen and bathroom renovations consistently rank among the highest ROI projects in Canada. A modern layout, durable surfaces, and energy-efficient fixtures can attract buyers and significantly boost resale value. However, major remodels increase your home’s replacement cost, potentially increasing your insurance premiums as well.

After completing renovations, obtain contractor estimates or appraisals, then update your coverage limits so you’re not underinsured if a fire or water event occurs. During construction, consider builder’s risk coverage or similar protections to mitigate liability and damage risks before completion. Keep detailed records of permits, invoices, and project specs.

Upgrade Insulation in Walls and Attics

Replacing or upgrading insulation in walls, attics, and crawl spaces makes your home more comfortable, reduces energy bills, and helps prevent freeze-related pipe bursts and condensation that can lead to mould. While insurers seldom give direct discounts just for insulation, the reduced risk of freeze damage and mould claims helps maintain stable premiums over time.

Ensure qualified contractors perform installations to avoid issues such as trapped moisture or improper airflow. If improved insulation is combined with HVAC upgrades or new ventilation systems, notify your insurer so they can see that you’re proactively reducing risk factors associated with common claims.

Invest in Sustainable Landscaping with Low Maintenance

Sustainable, low-maintenance landscaping enhances your home’s curb appeal and shows buyers that you’re dedicated to keeping your home well-kept. You can achieve this kind of lawn by using native, drought-tolerant plants, permeable surfaces, rain gardens, and wildfire-preventing landscaping principles.

Even if insurers don’t offer direct generic landscaping discounts, demonstrating that your yard mitigates flood or fire risk can support more favourable underwriting and attract risk-averse buyers.

Key Advice from MyChoice

- Before undertaking a home improvement project, check if any specific permits, equipment, or other requirements are required. Hire professional contractors to ensure that new fixtures are correctly installed and comply with all relevant codes.

- Check with your insurer to see if your home improvements qualify for discounts on your home insurance premiums.

- Regularly review your insurance policy and inform your insurer of any changes to avoid coverage gaps. Ensure that your insurance coverage matches your home’s value whenever you finish a home improvement project.